Tendering thought differently - the tendering process find. by ZWEI Wealth

Tenders are an incredibly good way of finding the best solutions. In reality, however, the tendering processes at pension funds have long since degenerated into an administrative nightmare that, apart from lower costs, hardly brings any major benefits. There is another way, as ZWEI Wealth proves with its tendering platform.

The principle of a 'tender' has long been established among pension funds and institutional investors and is well known. In a tender, several offers are obtained for a precisely defined order and the best one is selected. The basic idea behind this: Competition should make offers better and cheaper. In addition, new and higher quality concepts can also be put forward.

However, the reality rarely corresponds to this ideal. A major disadvantage of tenders as they are carried out in practice today is that they are too tightly restricted by very narrow specifications and many providers are not even contacted or do not participate themselves due to a large number of cumbersome preconditions. It is no longer the "best" offer that is chosen, but the cheapest from the large standard provider. Expensive and lengthy tenders with difficult-to-understand evaluations make the tendering process a pain for all sides.

This doesn't have to be the case. ZWEI Wealth's tendering platform offers an efficient alternative for pension funds and institutional clients. How does it differ from the traditional approach?

-

Open and broad tendering (advantage: many different solutions can be compared):

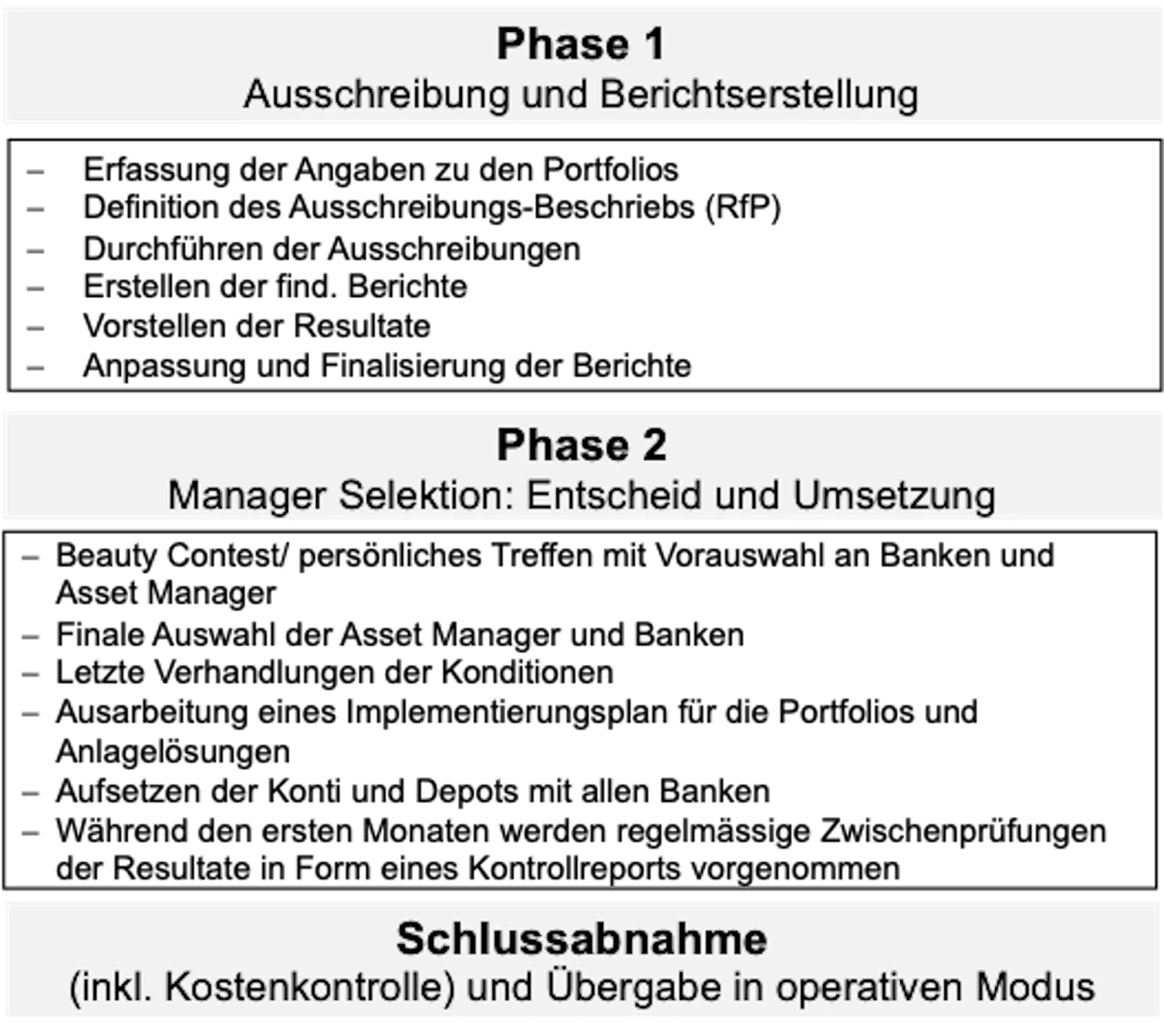

The ZWEI Wealth tendering platform offers a broad range of requirements. Instead of specifying narrow benchmarks, the platform allows broad requirements to be defined in order to evaluate as many solution approaches as possible. In addition, each tender is sent to over 500 banks and asset managers, so that a wide variety of responses are returned. -

Only the core information at the beginning, details at the end (advantage: many more offers):

The ZWEI Wealth tendering platform provides for a two-stage process. In the first step, the offers only have to include the most necessary information in order to create a shortlist. Only in the next step is all the detailed information collected. -

Payment by phase (advantage: much more flexibility):

The ZWEI Wealth platform allows tenders to be broken down by phase. If you only need an overview of tenders, e.g. for infrastructure, but want to conduct the rest of the negotiations directly with the provider, you only pay for the first module. This makes tenders an efficient and cost-effective tool.

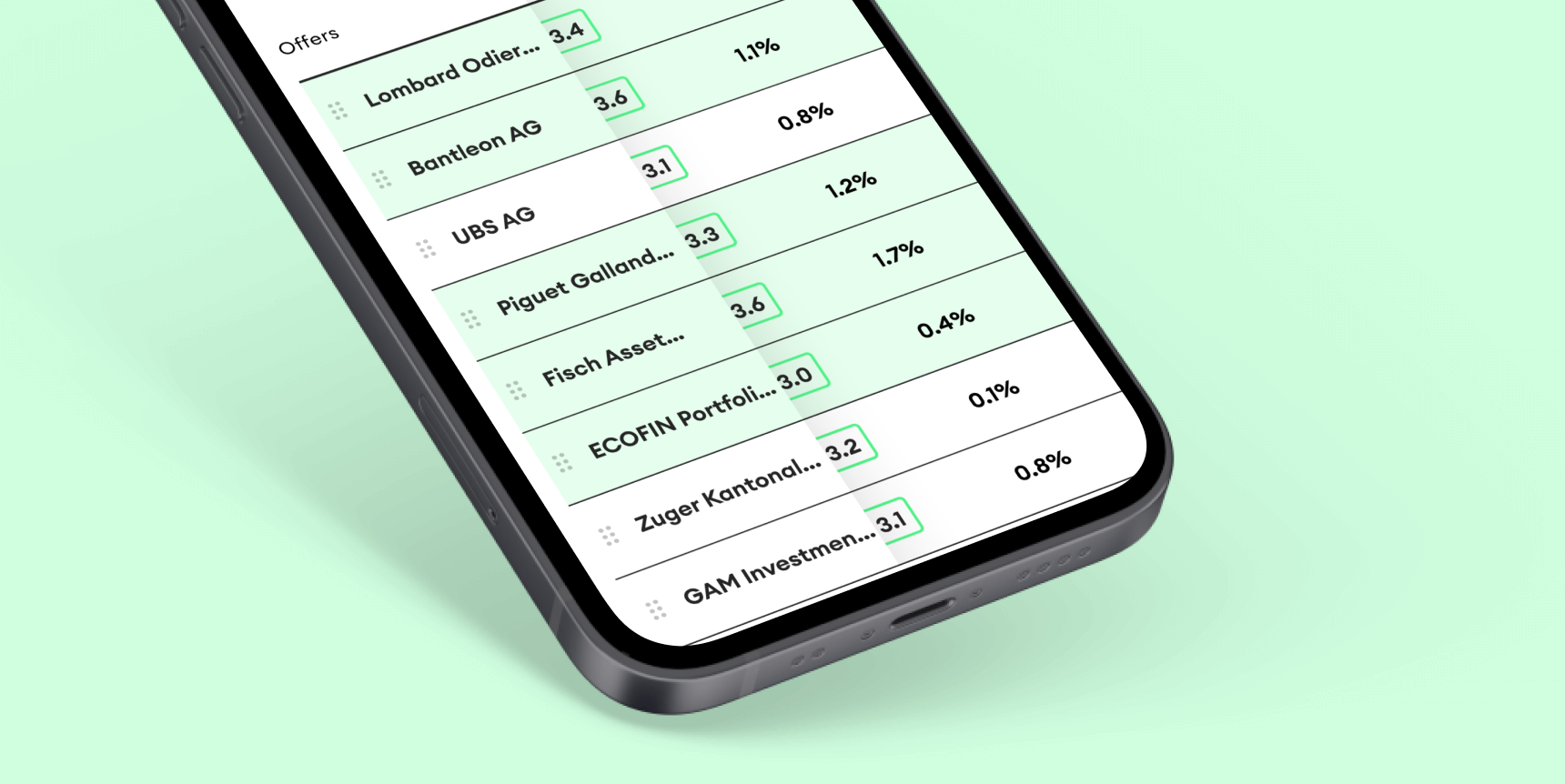

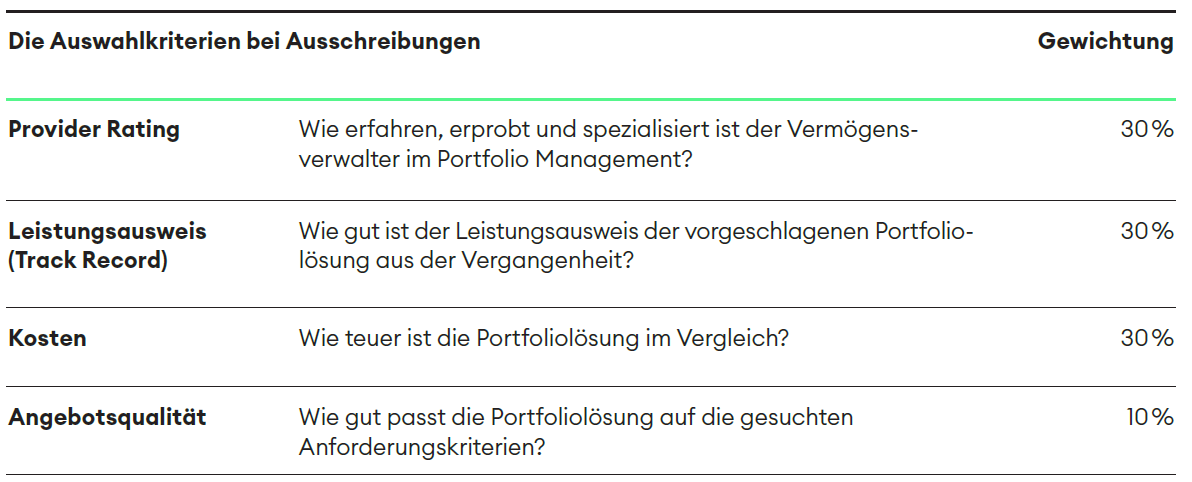

About the platform

ZWEI Wealth works with a large number of asset managers and fund managers to select the best possible portfolio for its clients. For all asset managers, ZWEI Wealth conducts comprehensive due diligence to ensure that the potential asset managers and fund managers can meet the client's requirements. This includes an analysis of the asset manager's or fund manager's investment strategy, track record and experience in asset management. ZWEI Wealth uses a platform developed specifically for this purpose, where clients can find a wide range of providers. The platform enables the tendering process to be handled quickly, effectively and in a highly automated manner. The assessment grid developed by ZWEI Wealth with four factors is used to evaluate the results. This includes the manager rating, analysis of the track record, comparison of the cost structure and the fit of the solution to the client criteria. With the help of ZWEI Wealth's benchmarking system, the results and costs achieved can be compared transparently and independently at any time. With the support of ZWEI Wealth, it is no longer difficult to find the right solution between the various alternatives. The adage "he who has the choice is spoiled for choice" has become obsolete, at least in the context of a tender.

The ZWEI Wealth platform:

- Open market access

- 500+ asset managers in various financial centers

- Free registration of asset managers

- ZWEI Wealth acts independently, no commissions from asset managers

- Success factors in the tendering process:

- Clearly defined investment objectives/requirements that are not restrictive

This means that no restrictions are imposed too early on, thereby provoking a one-sided view/examination of the investment category. - Comprehensive platform with a high degree of automation

The platform should guarantee access to the broadest possible universe of asset managers. At the same time, the platform must be highly automated and support the process for all participants to ensure efficient processing. - Transparent valuation process

A transparent evaluation process ensures that all offers are evaluated fairly and objectively. Clear criteria should be set for the valuation that meet the investor's objectives. - Thorough due diligence

Thorough due diligence of potential providers is crucial. This includes assessing their reputation, financial stability, risk management capabilities and regulatory compliance.

Access the transparency portal

Get free access to current studies on the topic of wealth.