Switching pays off

You don't change banks or asset managers . This principle seems to be crumbling . Because switching is becoming increasingly worthwhile for clients. In 2023 alone, more clients switched asset managers than ever before. Anyone can now order offers from banks and asset managers free of charge.

The latest analysis from ZWEI Wealth shows that more clients switched banks or asset managers last year than ever before. And done right, the switch pays off for clients many times over than is generally expected.

More and more are switching

In many areas of life, it is already common practice for customers to compare offers and switch providers, but this is even less the case for banks and asset managers. This is mainly due to the lack of transparency and the high costs for customers. It is easier to stay with the same bank than to go to the effort of switching and not be sure at first whether it is worth it.

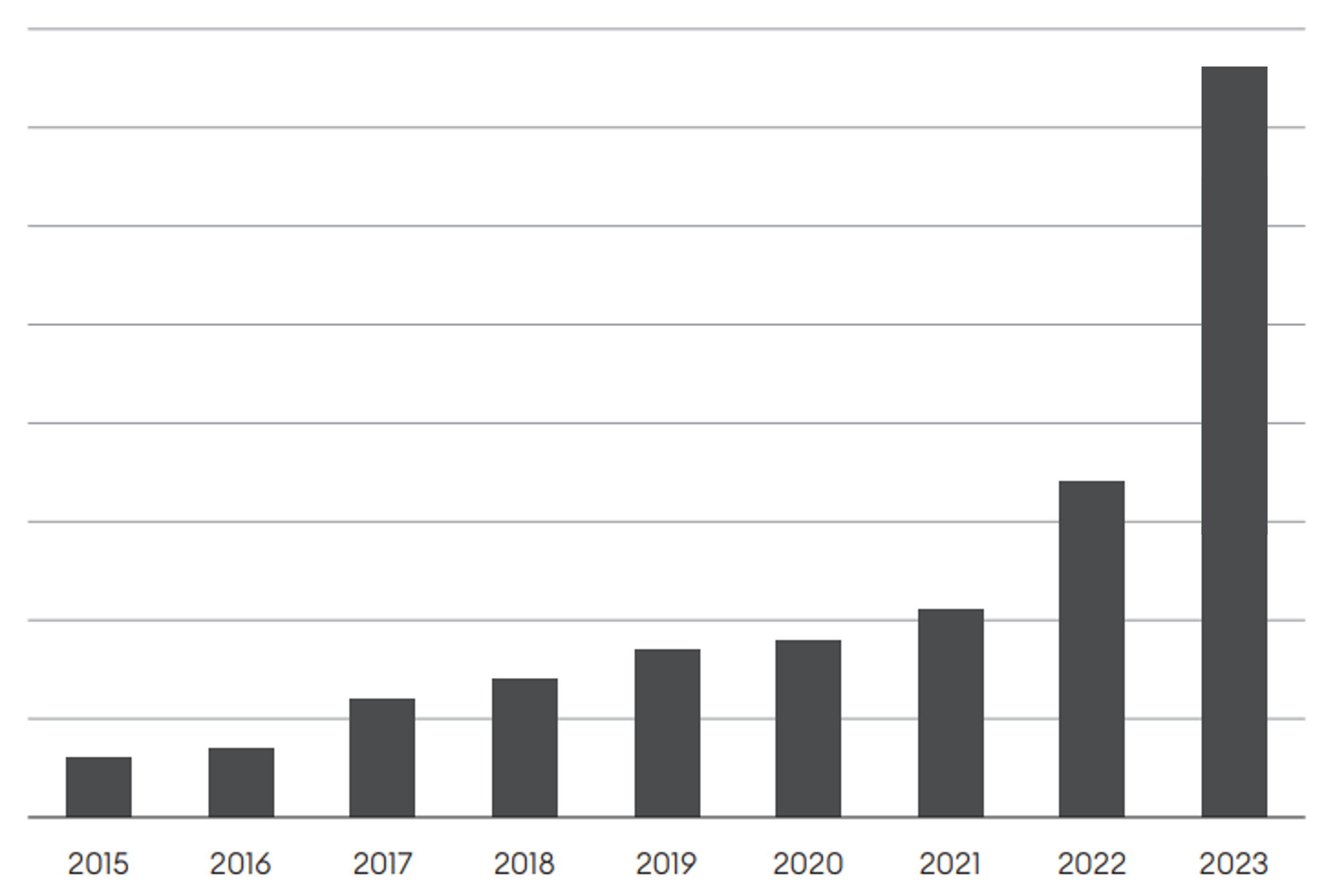

However, this is increasingly changing. Developments in recent years show a clear trend. The willingness to switch, including in wealth management, has increased significantly and continues to rise. In 2023, more clients in Switzerland switched banks or wealth managers than ever before. This can be seen, among other things, in the number of alerts on the ZWEI Wealth Office platform. The number of alerts from clients looking for new banks and wealth managers has grown by a good 30% every year since 2015. In 2023, the number of tenders rose by a staggering 120% (see chart). In addition to the general trend towards switching banks, the takeover of Credit Suisse by UBS naturally led to more clients wanting to switch banks in 2023.

Graphic: Number of tenders on the ZWEI Wealth Office platform (source: ZWEI Wealth)

Yes, switching is worthwhile

Many people are still reluctant to switch. Not so much because they are satisfied with their current bank and asset manager, but rather because they assume that a change will hardly bring any noticeable improvement. However, the evaluation of tenders in which customers were looking for a new bank or asset manager shows a clear picture:

- Customer satisfaction rose from 3.4 to 4.8 (of 5)

- Returns improved on average by 2.5% per year

- The total costs of asset management fell by an average of 34% per year

- For assets of CHF 1 million, this means an improvement of over CHF 300,000 over 10 years

The figures illustrate two aspects. Firstly, most clients today pay too much for inadequate services. Secondly, the good asset managers work much better and are not more expensive. This is because in asset management, too, it is the clients who benefit from transparency and competition. This is good for the entire industry.

Your ZWEI Wealth Officer will be happy to provide you with more information.

Example 1 - Bank client

- Mandates that better met her needs for distribution and growth

- Her mandate with the cantonal bank achieved returns that were 1-2 percentage points below the benchmark every year. Both new mandates achieved a return on benchmark or 1.2 percentage points above in the first year.

- The total costs fell by 56% per year

Example 2 - Entrepreneur

Mr. Muster* was a successful entrepreneur . After selling his company , he had part of his assets managed by a major bank and managed the rest himself. He received 37 offers from banks and asset managers in a tender and selected one:

- 1 mandate that met his requirements 100% and was managed in a way that he could not do himself.

- The mandate exceeded the desired distribution yield of 4% p.a.in the first 18 months.

- The conditions for the self-managed portfolio were renegotiated as part of the tender process

- The total costs fell by 64% p.a.

Example 3 - Foundation

The model foundation invests the foundation's assets in a value-preserving manner. To this end, the foundation maintained two banking relationships with a corresponding mandate for asset management.The foundation received 24 offers in a tender and selected two of them.

- One of the existing banks successfully adapted the mandate and conditions

- A new bank was selected for the additional management of the growth portfolio.

- For the first time, the Foundation's portfolios are achieving returns that can be compared with the best.

- Total costs fell by 38%.