Provider comparison: What rating does your bank or asset manager have?

The provider rating from ZWEI Wealth is the only independent quality seal for the portfolio management of a bank or asset manager. You can order the rating of your bank or asset manager free of charge.

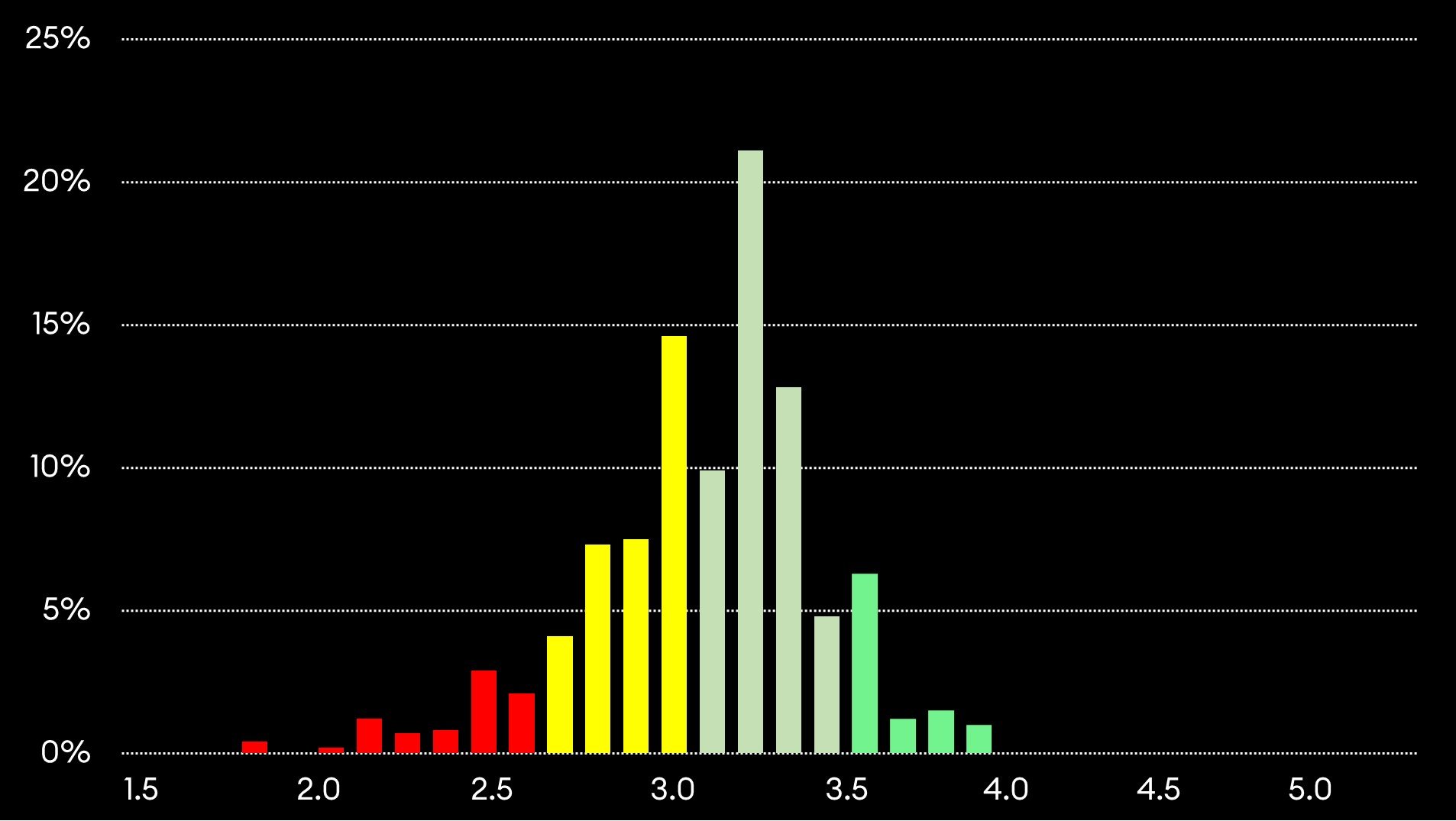

Distribution of provider ratings (as at April 2024)

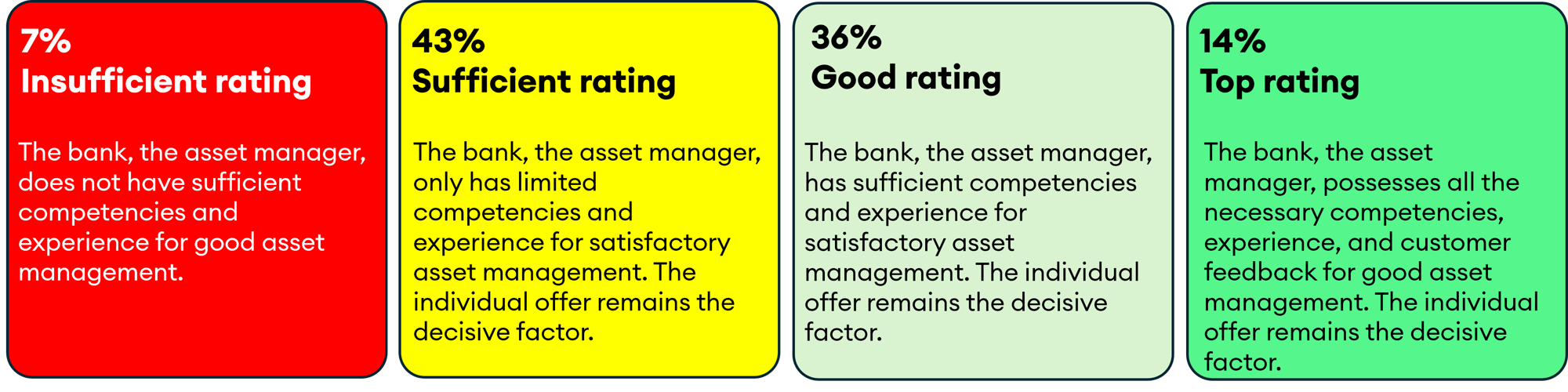

The chart shows the distribution of ratings across all banks and asset managers. A good 47% of providers on the ZWEI Wealth Office platform achieve a "good" or "highly recommended" rating.The rating is based on a comprehensive list of criteria and can be viewed by all parties, clients and providers at .

The ZWEI Wealth provider rating comprises seven criteria:

What are the quality characteristics of good portfolio management? Thanks to the experience and analyses of recent years, ZWEI Wealth is able to assess banks and asset managers in terms of the key success factors. We have developed a rating system from this. The cornerstones of the rating methodology are described below. Essentially, the provider rating primarily summarizes the stability, experience, specialization and track record of an asset manager. The rating follows a strictly rule-based logic. The rating for a bank or asset manager is created when they register on the ZWEI Wealth Office platform or at the client's request and is regularly reviewed and adjusted.

- How long has the company existed?

Numerous studies have shown that many companies do not survive the first few years. For example, companies that survived the major financial crisis of 2007/08 at least have a tried and tested investment concept.

- How many assets are managed?

Although some managers have been around for a long time, assets under management of less than CHF 100 million tend to indicate "friends & family" or 2-3 large investors. From CHF 1 billion, greater trust is established with investors.

- How many employees are employed?

A company with 11-250 employees is large enough, but still agile enough to make adjustments. Too few employees typically entail a high personal risk when key people leave. Too many employees have the risk of bureaucracy and inefficient cost structures for clients. - How specialized is an asset manager?

Experience and studies show that a high degree of specialization also tends to lead to better results for clients in asset management. - What is the ownership structure?

Listed companies are subject to the pressure of quarterly results, which can lead to a major conflict of objectives. Family or partner companies can plan for the longer term, which typically has a positive effect on the results achieved for customers. - Are the necessary licenses available?

We check whether the administrator has the necessary licenses for the selected activity. - Service quality

Service quality is measured on the basis of feedback from experts and clients as well as actual results achieved.