Active or passive? Both are possible!

In asset management, this is almost a question of faith. Some swear by active asset management. Others preach the superiority of passive implementation with ETFs. Who is right?

-1.png?width=1200&name=zwei%20welth%20post%20Aktiv%20Passiv%20(1)-1.png)

In an analysis, we compared offers for active and passive asset management. We compared 154 offers from banks and asset managers in three portfolio categories (bonds, mixed and equity portfolios). The findings confirm many of the known facts and are surprising in some areas.

There is no clear definition

When analyzing the offers, it quickly becomes clear that there is no clear dividing line between 'active' and 'passive'. Asset management is generally referred to as 'passive' as soon as the investments are made in ETFs or index funds. However, an investment strategy is still actively selected in such asset management.

Returns from actively managed portfolios are slightly better

In the offers examined, the return results are slightly in favor of active asset management. The advantage of active asset management is particularly pronounced for bond portfolios. The advantage is hardly significant for mixed and equity portfolios.

Passive portfolios have a lower diversification

In the analysis, the difference in returns from the best offer to the worst is many times greater for actively managed portfolios than for passive portfolios. In active asset management, the choice of manager and offering is much more important than in passive portfolios.

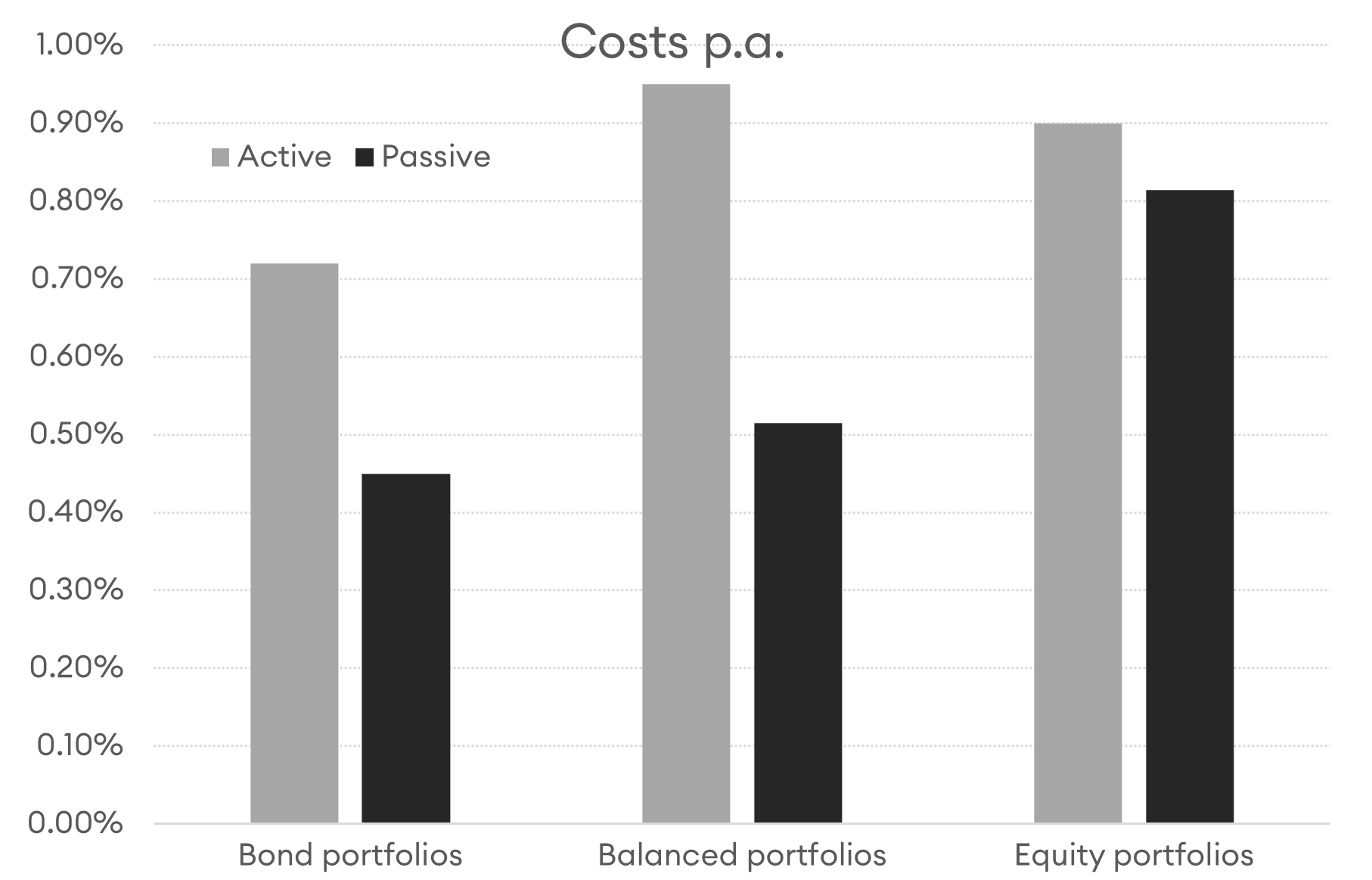

Passive portfolios are cheaper

Passive asset management has a reputation for lower costs. The analysis here shows that active managers have now become more competitive. Although passive asset management still has lower costs, the differences between the good offers have become much smaller.

Conclusion

Good asset management can be achieved with both active and passive management. Above all, it requires a tried-and-tested investment concept, good implementation and low costs.

Which strategy suits you?

Order the performance comparison now HERE and discover the optimal investment strategy for your individual goals!