Distributing portfolios

Portfolios that focus on a predictable distribution yield that is as secure as possible. The spectrum ranges from interest income, rental income and dividend income to option premium strategies.

76 offers available

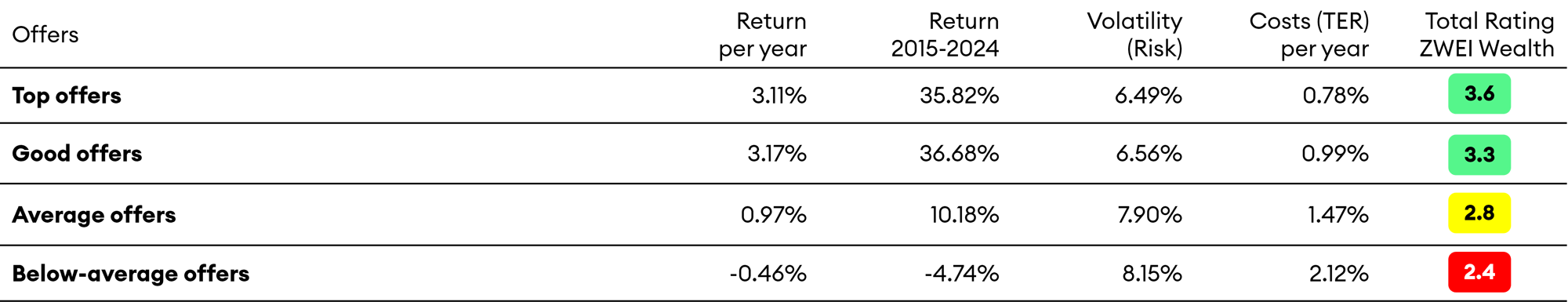

Overview of the best offers

Below you will find the details of the best offers for asset management in this portfolio category. The table shows the returns, risk metrics and costs of the best offers compared to others. The names of the offers are neutralized because the offers only apply to individualized offers via ZWEI Wealth. The calculations and details below are based on a portfolio size of CHF 1 million. The offers and prices vary according to the size and type of assets.

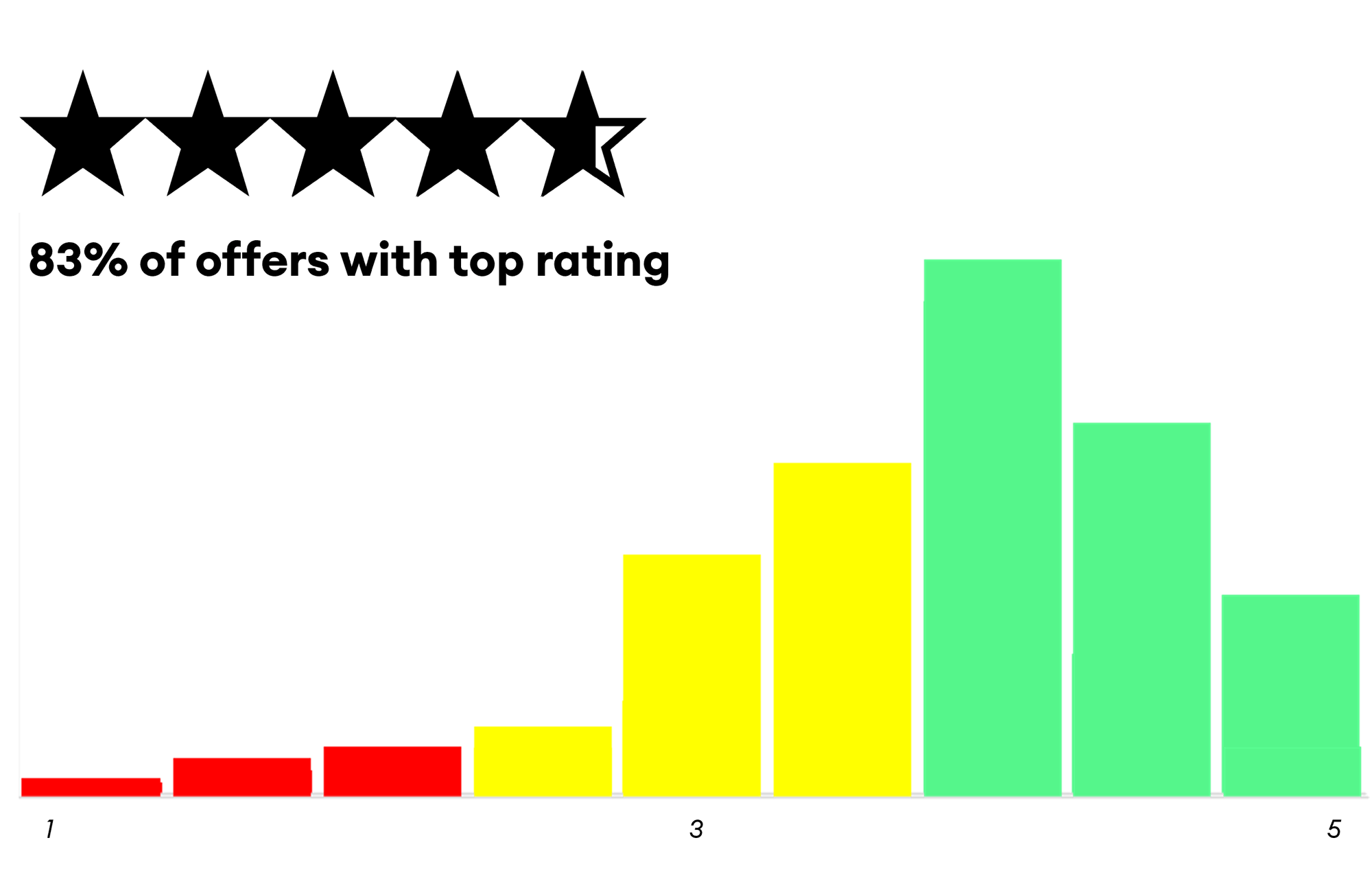

Caption: 1=completely unsatisfactory / 2=unsatisfactory / 3=sufficient / 4=very good / 5=excellent

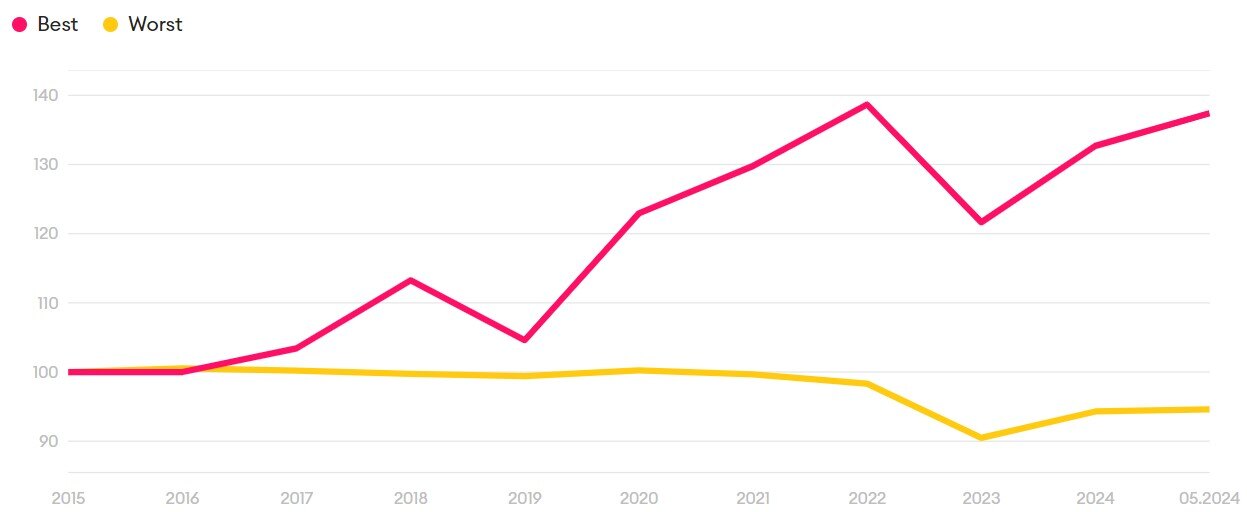

Historical returns of the offers (2015-2023)

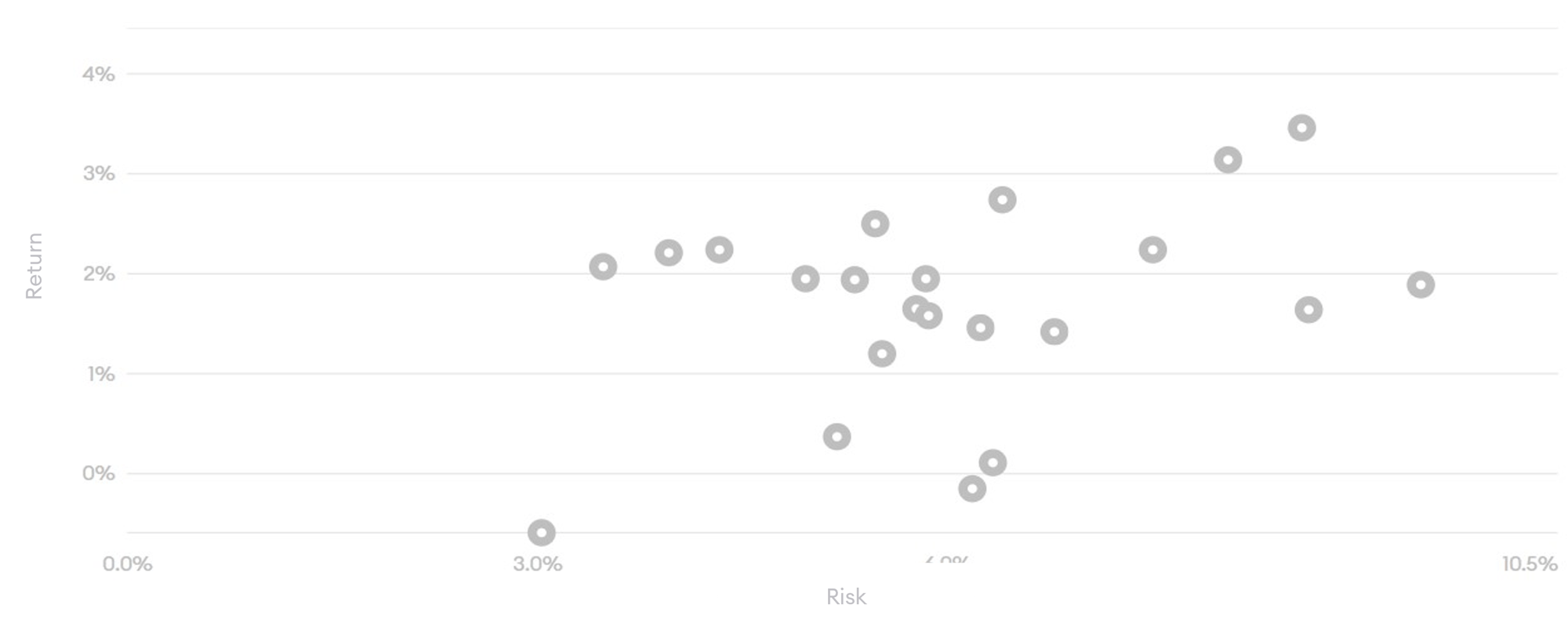

Risk/return ratio of the best offers

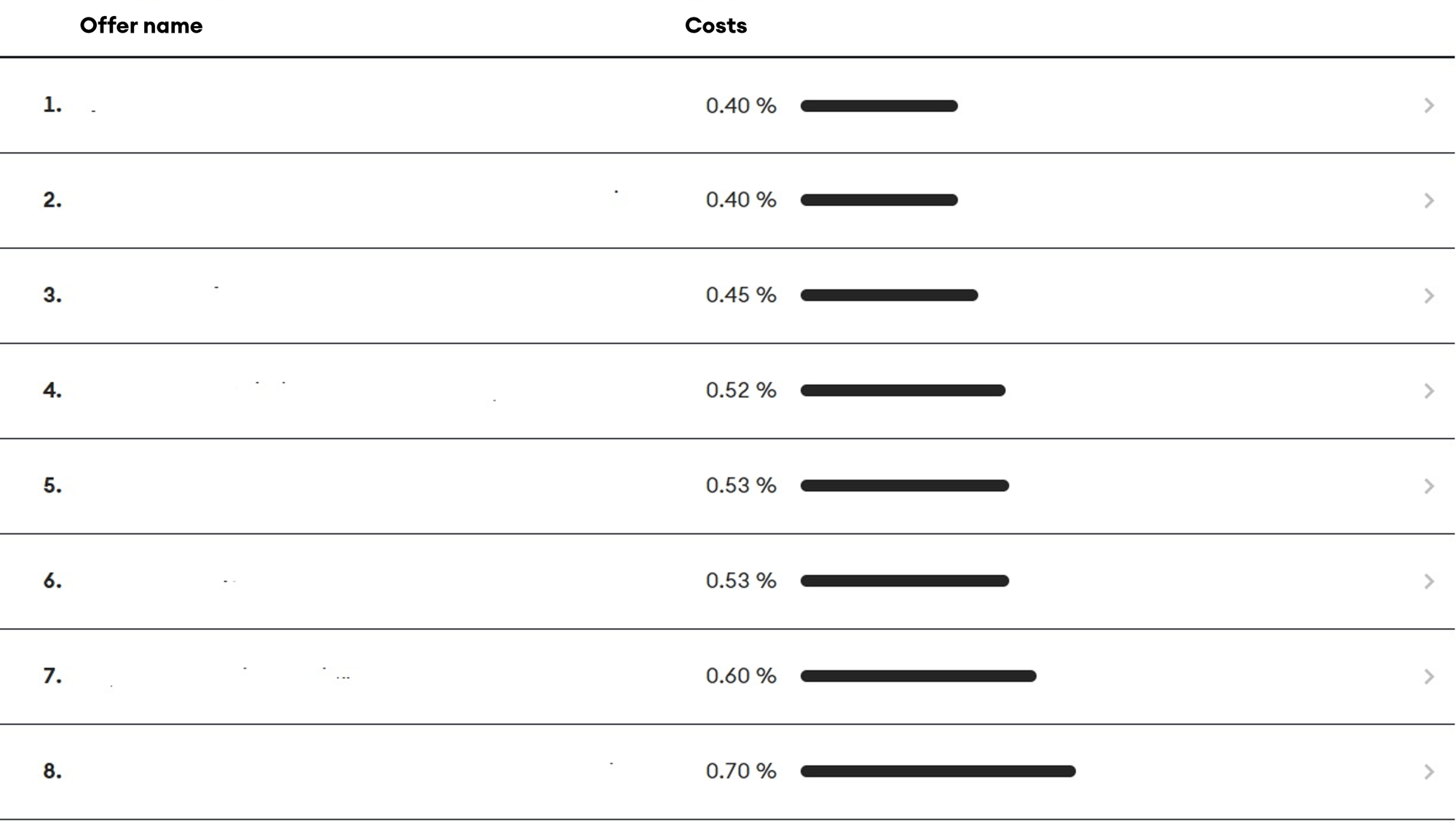

Cost of the best offers

Assessment of the offers

Caption: 1=completely unsatisfactory / 2=unsatisfactory / 3=sufficient / 4=very good / 5=excellent

Launch your own tender

free of charge and without obligation